Leveraging Replacement Asset Value to Optimize Maintenance Budgets

The complex world of maintenance management is rife with jargon, data, and financial metrics that serve as the foundation for decision-making when it comes to maintenance investments. These metrics help determine the operational efficiency, financial viability, and long-term strategic planning for businesses across industries. One such crucial financial metric is Replacement Asset Value (RAV).

The importance of understanding RAV in maintenance management cannot be overstated. It provides a benchmark for maintenance professionals, enabling them to determine whether the costs of maintaining an asset are justified or if it would be more economical to replace it. Moreover, RAV forms the foundation for calculating other crucial financial performance indicators in maintenance management, thereby shaping the broader financial strategy of equipment management.

What is Replacement Asset Value?

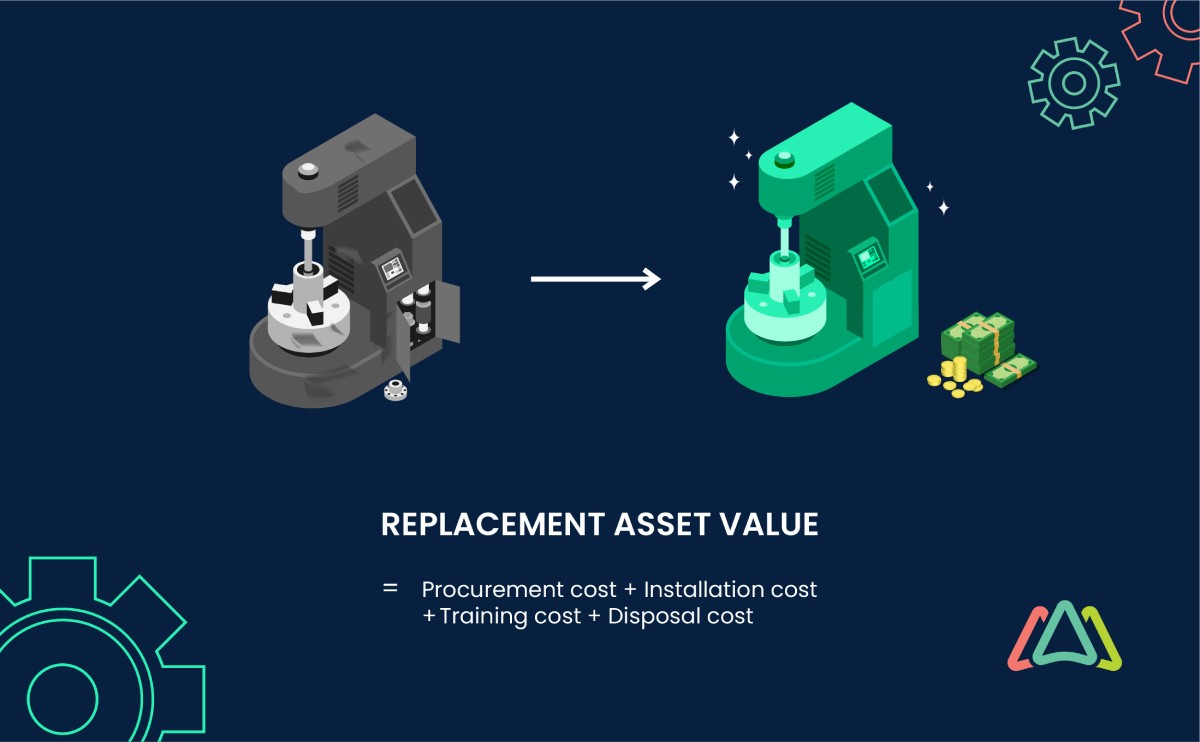

RAV stands for Replacement Asset Value, a financial metric that reflects the current cost to replace an asset at its existing capacity and performance level. It’s not just the list price of an asset, rather a comprehensive figure that mirrors all the costs that would be incurred to purchase a new asset of similar quality and make it operational.

It includes procurement costs, installation expenses, commissioning costs, and any other related expenses necessary for the asset to perform its intended function. Therefore, RAV provides a more accurate and holistic financial assessment of an asset’s value.

Key Components that Contribute to RAV

RAV is not a one-dimensional value; it incorporates several key components, each of which contribute to the overall replacement cost.

- Procurement Costs: This refers to the cost of acquiring the new asset, including the price of the asset itself and any associated taxes, shipping charges, or import duties.

- Installation Costs: Once an asset is procured, it needs to be installed before it can start delivering value. The installation costs include all expenses related to setting up the asset, such as labor costs, costs for any necessary modifications to the facility, and expenses for any necessary tools or equipment.

- Commissioning Costs: After installation, the asset needs to be tested to ensure it operates correctly and safely. The commissioning process might require professional services, software, and other resources, the costs of which also form part of the RAV.

It's important to note that the RAV might also include costs associated with training staff to operate the new asset and disposing of the old one. These costs can be substantial, particularly for complex machinery or technologically advanced assets, and should not be overlooked when calculating the RAV.

Replacement Asset Value Calculations

Calculating the Replacement Asset Value is a critical aspect of financial planning and asset management. An accurate RAV provides a realistic basis for several crucial financial decisions, such as setting maintenance budgets, planning capital investments, and evaluating the efficiency of maintenance strategies.

For instance, if the maintenance cost of an asset is approaching or exceeding its RAV, it might indicate that replacing the asset would be more economical than continuing to maintain it.

Furthermore, RAV is a fundamental input in the calculation of key financial performance indicators like the total maintenance cost as a percentage of RAV. These indicators provide valuable insights into the financial performance and operational efficiency of an organization, making RAV a vital component in the broader maintenance management strategy.

Step-by-Step Process for Calculating RAV

Calculating the Replacement Asset Value involves a few steps and takes several factors into account. Here is a step-by-step guide:

- Determine the Procurement Cost: The procurement cost is the cost of purchasing the asset. It includes the price of the asset, plus any taxes, shipping fees, import duties, or other costs associated with its acquisition.

- Calculate the Installation Cost: The installation cost includes the expenses associated with setting up the asset. This includes labor costs, any modifications to the facility required to accommodate the asset, and the costs of necessary tools or equipment.

- Include Commissioning Costs: After installation, the asset must be commissioned to ensure it functions properly. The commissioning cost could include the cost of professional services, software, and other resources needed to bring the asset to an operational state.

- Add Training and Disposal Costs: Also take into account the cost of training staff to operate the new asset and the cost of disposing of the old one.

- Add Up All Costs: The final step is to add up all these costs. The sum gives you the Replacement Asset Value.

Variables to Consider When Calculating RAV

When calculating RAV, keep in mind that each asset is unique, and the components of the RAV may vary. Some of the key variables to consider include:

- The type and nature of the asset: Different assets will have different procurement, installation, and commissioning costs.

- The technology and complexity of the asset: More complex or technologically advanced assets may require more resources to install, commission, and operate, which could significantly increase the RAV.

- The lifecycle stage of the asset: The age and condition of the asset can influence its replacement cost.

- External factors: Factors such as market prices, inflation rates, and availability of resources can also impact the RAV.

Illustrating the Calculation Process

Consider a simple example:

A piece of machinery in a manufacturing plant needs to be replaced.

The machine costs $80,000.

Shipping and taxes amount to $8,000.

The cost to install the machine is $5,000.

Training staff to operate this new machine costs $3,000.

And let's say you've accounted for $1,000 for the decommissioning and disposal of the old machine.

To calculate the RAV, you add up all these costs:

Replacement Asset Value =

Procurement cost + Installation cost + Training cost + Disposal cost

So, the RAV in this example would be

= $80,000 (purchase) + $8,000 (shipping and taxes) + $5,000 (installation) + $3,000 (training) + $1,000 (disposal)

= $97,000.

These figures are just for illustrative purposes, and actual costs will depend on various factors. By understanding and correctly implementing this process, maintenance managers can leverage RAV to make informed financial decisions and optimize their asset management strategy.

Role and Significance of RAV in Maintenance Management

The Use of RAV as a Benchmark for Assessing Maintenance Strategies

RAV forms the basis for several key performance indicators that assess the effectiveness and efficiency of maintenance strategies. One of the most common is the Total Maintenance Cost (TMC) as a percentage of RAV. This indicator compares the total annual cost of maintaining assets to their RAV, providing a measure of how effectively resources are being used to maintain the assets. This comparison provides maintenance managers with an objective measure to evaluate and refine their strategies, thereby ensuring optimal utilization of resources and enhanced operational efficiency.

Lower percentages typically indicate more efficient maintenance strategies.

According to Standard SMRP Best Practices Metrics, the optimal target value for best-in-class maintenance management typically falls below 3%. The top quartile range, which varies across industries, ranges from 0.7% to 3.6%.

The SMRP data also suggests that non-industrial facilities tend to spend less compared to industries like mining. However, even among the best performing facilities, the differences in spending is not much. The range mentioned above represents the lowest target value (0.7%) for the least demanding industry and the highest target value (3.6%) for the most demanding industry within the top 25% of facilities. The appropriate target value for a facility would be based on its size, complexity of maintaining the equipment, purchase price of assets and much more.

Let’s take a look at this ratio from a different perspective. If an organization’s annual maintenance spending is at 0.7% of its Replacement Asset Value, it implies a relatively low proportion of resources are allocated to maintenance. In this case, it would take approximately 142.9 years (1 / 0.007) for the cumulative maintenance costs to equal the cost of purchasing a whole new facility.

Similarly, a higher TCM to RAV ratio of 10% suggests the need for higher allocation of resources toward maintenance. In this scenario, it would take approximately 10 years (1 / 0.1) for the cumulative maintenance costs to reach the cost of acquiring a new plant.

It's important to note that these timeframes are approximate and can vary depending on factors such as inflation, asset lifespan, and other considerations specific to the company's operations.

How RAV Helps in Decision Making - When to Maintain or Replace an Asset

The decision to maintain or replace an asset is a critical one in maintenance management, and RAV plays a significant role in this decision-making process. If the cost of maintaining an asset consistently approaches or exceeds its RAV, it might be more economical to replace the asset rather than continue maintaining it.

By providing a clear picture of the replacement cost, RAV allows maintenance professionals to make informed, data-driven decisions about whether to keep investing in maintenance or proceed with replacement.

Role of RAV in Strategic Planning and Long-term Asset Management

Apart from its immediate applications, RAV also has strategic implications for long-term asset management. It serves as an invaluable tool in capital budgeting and planning, helping businesses anticipate future expenses and allocate financial resources more effectively.

With a clear understanding of the RAV of their assets, organizations can plan for asset replacements and allocate capital investments more accurately. It also aids in determining the lifespan and depreciation of assets, providing valuable insights that can guide the creation of long-term asset management strategies.

In conclusion, RAV's role extends beyond just being a financial metric. It functions as a benchmark, a decision-making tool, and a strategic planning resource, underscoring its role in maintenance management. It equips professionals with the information they need to manage assets efficiently and effectively, thereby contributing significantly to the financial health and operational success of the organization.

The Impact of RAV on Key Financial Performance Indicators

In maintenance management, financial performance indicators are important for evaluating the effectiveness of maintenance strategies, decision-making, and long-term planning. RAV impacts the following financial KPIs :

- Total Maintenance Cost (TMC): This is the total annual cost of maintaining an organization's assets. It can be measured as a percentage of RAV to assess the proportion of the asset's value being spent on maintenance. If the TMC consistently approaches or exceeds the RAV, it may indicate the need to reconsider maintenance strategies or possibly replace the asset.

- Maintenance Cost per Unit (MCU): This is the cost of maintaining an asset per unit of output. MCU can be used to assess the efficiency of maintenance efforts. The MCU may rise if maintenance costs approaches or exceeds the RAV, indicating inefficiency. Keeping a close eye on RAV helps prevent this scenario and keep the MCU in check.

- Return on Assets (ROA): ROA measures how fiscally efficient a company is with respect to how it uses its assets. A high ROA indicates that the company is efficient with its use of its assets and generates positive returns. If the RAV of an asset is high, the returns from that asset need to be equally high to achieve a good ROA. Conversely, if an asset with a high RAV is underperforming, it may pull down the overall ROA.

The Impact of RAV on Financial Performance Across Sectors

- Consider a manufacturing company that has been spending a substantial amount on the maintenance of a particular machine. The TMC as a percentage of the machine's RAV has been steadily increasing over the years. After a thorough analysis, the company decides to replace the machine as the maintenance costs were reaching the machine's RAV. After replacement, the company saw a substantial decrease in the TMC as a percentage of RAV and an improvement in the ROA, demonstrating the cost-effectiveness of the decision.

- Let's consider a case from the energy industry: A power generation company operates several wind turbines. Over time, the Maintenance Cost per Unit (MCU) for these turbines has been increasing, largely because the turbines' Replacement Asset Value (RAV) has remained relatively constant, but the maintenance costs have been rising due to the aging infrastructure. Recognizing this trend, the company decides to replace some of its older turbines with newer, more efficient models. This decision increased the overall RAV, as the new turbines were more expensive. However, these newer turbines were also much more efficient and required less maintenance, resulting in a decrease in the overall MCU. After implementing these changes, the company found that it was able to produce more energy at a lower maintenance cost per unit, thus improving their overall efficiency and profitability.

These examples illustrate how understanding RAV can have a direct impact on key financial performance indicators, allowing for more informed decision-making and improved financial performance. RAV plays a pivotal role in the financial management of maintenance operations, regardless of the industry.

How to lower the TMC to RAV percentage

The Total Maintenance Cost (TMC) to Replacement Asset Value (RAV) ratio is a critical performance indicator in asset management. A high percentage indicates that maintenance costs are substantial in comparison to the cost of replacing the asset, which may signal inefficiencies in your maintenance operations. Here are some ways to lower the TMC to RAV percentage:

- Implement Preventive Maintenance: Regular preventive maintenance can help identify and fix small issues before they escalate into larger, more costly problems. Preventive maintenance can reduce both the frequency and cost of major repairs, thereby lowering TMC.

- Invest in More Durable Assets: If the TMC to RAV percentage is high for specific assets, it might be beneficial to invest in more durable models of those assets. More reliable equipment often requires less maintenance and thus can bring down the overall maintenance cost.

- Train and Upskill Maintenance Staff: Improving the skills of your maintenance staff and enables them work more efficiently, reducing the need for repeated repairs or replacements. Training staff on advanced maintenance techniques, such as predictive maintenance, can further drive down maintenance costs.

- Improve Spare Parts Management: Efficient spare parts management can minimize downtime and unnecessary costs for rush orders, both of which contribute to high maintenance costs. Implementing a spare parts inventory system ensures parts are available when needed without carrying excessive stock.

- Utilize Maintenance Management Software: Implementing maintenance management software helps track and analyze maintenance activities and provides visibility into maintenance costs. Insights derived from this data help identify inefficiencies, predict potential issues, and streamline maintenance processes, all of which contribute to lower maintenance costs.

- Asset Lifecycle Management: Have a clear understanding of the lifecycle of each asset. Plan and implement a schedule for phased replacement of assets that are nearing the end of their useful life. This prevents incurring high maintenance costs on assets that should be replaced.

It’s important to regularly review and adjust these strategies as necessary to ensure they remain effective in controlling maintenance costs. The goal isn’t just to lower the MC to RAV percentage, but to achieve an optimal balance between maintaining existing assets and investing in new ones.

Challenges in Calculating and Implementing RAV

Common Difficulties in Accurately Calculating RAV

Calculating the Replacement Asset Value (RAV) can be challenging. One common difficulty is the estimation of the various costs that make up the RAV. The procurement, installation, and commissioning costs can fluctuate based on factors such as market prices, inflation rates, and changes in technology.

Moreover, predicting future costs for assets that may not be replaced for several years is an inherently uncertain process. Changes in technology, suppliers, and business requirements can impact the future RAV of an asset.

Potential Obstacles in Using RAV for Decision-Making

Even with an accurate RAV, there are obstacles when it comes to applying it to decision-making processes.

One obstacle is the resistance to change. The decision to replace an asset based on its RAV may not be received well, especially if there are high upfront costs associated with replacement.

Furthermore, applying the RAV in decision-making isn't that easy. It involves weighing the costs of replacement against the costs of continued maintenance, considering factors such as the asset's importance to operations, its remaining useful life, and the expected benefits of new technology.

Ways to Overcome Challenges in Using RAV for Decision-Making

To overcome these challenges, organizations can do the following;

- Implement a robust cost tracking and forecasting system to get more accurate and timely data.

- Clearly communicate the benefits of asset replacement and the role of RAV in this decision to manage resistance to change.

- Educate stakeholders about the long-term cost savings and efficiency gains to help garner support for these decisions.

When dealing with the complexity of applying RAV, it can be helpful to use decision support tools and frameworks that take multiple factors into account. These tools can help visualize the trade-offs and provide a more holistic view of the decision at hand.

Tools and Frameworks for RAV-Driven Decision-Making

Here are a few support tools and frameworks for integrating RAV into strategic maintenance planning:

- Risk Assessment and Prioritization: Tools like Failure Mode and Effects Analysis (FMEA) and Criticality Analysis assist in assessing asset risks and prioritizing maintenance activities. By considering the potential consequences of asset failure and the associated RAV, organizations can make informed decisions on maintenance investments.

- Computerized Maintenance Management Systems (CMMS): With features such as asset condition monitoring, maintenance planning, cost tracking, and reporting capabilities, a CMMS software can help organizations gain valuable insights into RAV-related data leading to informed decision-making.

- Decision Trees: Decision trees provide a visual representation of decision options and potential outcomes. By mapping out different maintenance strategies, considering factors such as RAV, costs, asset condition, and performance indicators, decision trees help stakeholders assess the potential consequences of each choice. This facilitates the identification of the most favorable course of action.

- Life Cycle Cost Analysis (LCCA): LCCA compares the total costs of different maintenance strategies over the asset's life cycle. It considers factors such as initial costs, maintenance costs, expected lifespan, and salvage value. This tool helps organizations determine the most cost-effective maintenance approach.

- Optimization Models: Mathematical optimization models, such as linear programming or dynamic programming, can be used to optimize maintenance strategies based on RAV. These models consider various constraints, such as budget limitations, asset criticality, and maintenance resource availability, to determine the optimal allocation of resources.

Conclusion

Understanding RAV is useful with strategic planning and long-term asset management, helping organizations make informed decisions about asset allocation, capital investments, and maintenance budgeting. By offering a realistic picture of the replacement cost of assets, RAV enables maintenance professionals to better manage their resources and make better decisions that improve financial performance and operational efficiency.

TABLE OF CONTENTS

Keep Reading

Ever find yourself checking into a luxury hotel and expecting a relaxing stay, only to find a ...

11 Apr 2025

Organizations are witnessing swift changes in the business environment and confronting a ...

8 Apr 2025

Last month, news outlets and the entire internet was abuzz with the return of NASA astronauts ...

3 Apr 2025

What comes first - CMMS or predictive maintenance? If your answer is either, it is correct. ...

28 Mar 2025

Artificial intelligence (AI) talk has become commonplace. Today, engaging in business-focused ...

27 Mar 2025

Imagine a world where machines predict, diagnose, and fix their issues before they fail. This ...

25 Mar 2025

A facility maintenance plan is at the core of a facility’s operations. This organized ...

21 Mar 2025

Think of managing your maintenance operations like managing a championship sports team. Just ...

21 Mar 2025

The maintenance sector is battling a severe talent shortage that threatens to undermine ...

7 Mar 2025

Manufacturing maintenance is the backbone of industrial efficiency, ensuring machines run ...

5 Mar 2025

No one likes playing a guessing game when equipment breaks down. Yet, maintenance teams often ...

4 Mar 2025

The size of the preventive maintenance software market is discussed in millions of dollars, ...

4 Mar 2025

The organizational structure and corporate hierarchy vary from company to company. Large ...

28 Feb 2025

Maintenance procedures are essential for ensuring the longevity and reliability of machinery ...

21 Feb 2025

Sustainability is no longer just a buzzword; it's a critical component of corporate social ...

20 Feb 2025

A Computerized Maintenance Management System (CMMS) relies on accurate, well-organized data ...

18 Feb 2025

In an era where technology drives operational efficiency, Computerized Maintenance Management ...

14 Feb 2025

A Computerized Maintenance Management System (CMMS) is a key component of modern maintenance ...

13 Feb 2025

Introduction Maintenance management is the foundation of maintenance operations in industries ...

11 Feb 2025

Introduction A Computerized Maintenance Management System (CMMS) is software designed to help ...

7 Feb 2025